Norway’s monetary policy regime formally changed to inflation targeting in March 2001. In the following years, Norges Banks’s practicing of the new policy regime impacted significantly on the interest rate level. However, soon after the coming of the international financial crisis, the footprints of inflation targeting became more difficult to follow in the data, and they soon disappeared altogether.

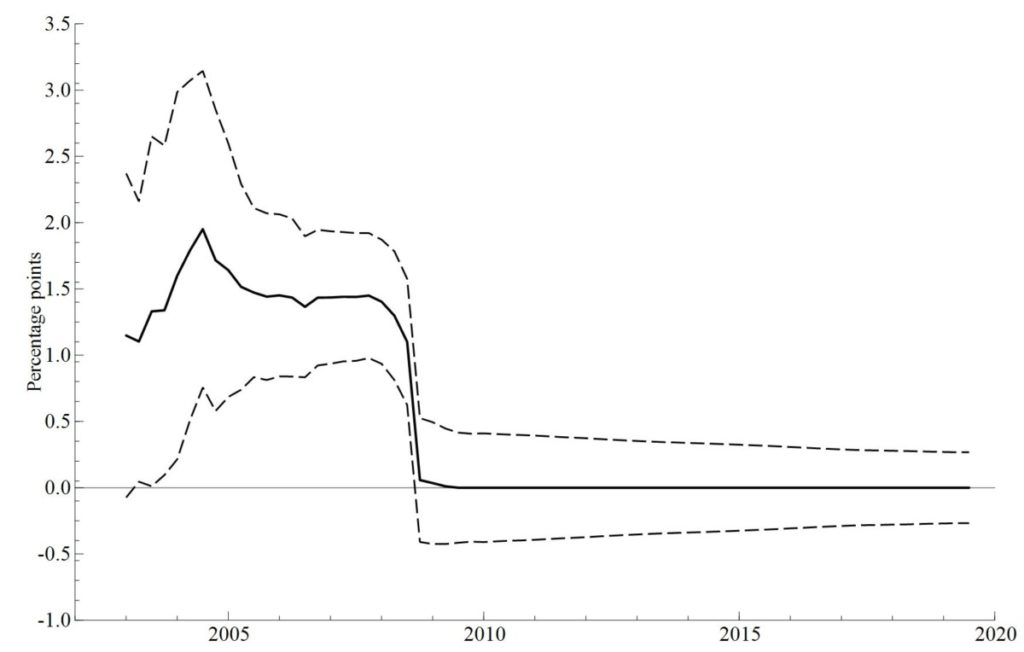

The figure below tracks this development by showing an estimated “Taylor-coefficient” which measures by how much the policy interest rate can be expected to increase when the inflation gap changes by one unit.

In the heyday of inflation targeting, an increase in the inflation gap could be expected to lead to an even larger increase in the policy rate. However, soon after the financial crisis the estimated Taylor coefficient plunged down zero. On the face of it, the epoch of inflation targeting was over almost as soon as the regime had installed itself.

Norges Bank cut policy interest rate three times in the autumn of 2009. However, on exact which day, 15 October, 20 October or 17 December, inflation targeting became defunct may better be left is for the monetary policy historians to find out.

Posted 8 January 2020. pdf-version