Structural breaks represent the nemesis of economic forecasters. This is true for all forecasting, no matter which method (or “machine”) is used to produce the forecast, as regime shifts are features of the evolving real world economy, not of the forecasts.

However, model based forecasters in particular experience that the forecasts of some endogenous variables can be seemingly robust with respect to structural breaks that are detrimental to other endogenous variables.

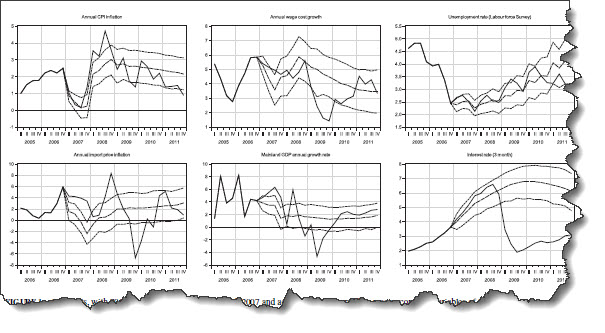

The picture below shows more than ten year old forecast form the Norwegian Aggregate Model (NAM) for a selection of variables (with confidence bounds), together with actuals for the period 2007q1-2011q4. Some forecasts fail after the outbreak of the financial crisis (for example the interest rate, the third figure in the second row!), but for several of the others, the forecasts are not so bad. There are many possible explanations for such seemingly partial robustness to a break, including a (surprising ?) degree of block recursiveness, inherent are created by policy intervention.

The picture is taken from an article titled Forecast robustness in macroeconometric models, just published in the Journal of Forecasting, by Gunnar Bårdsen (NTNU), Dag Kolsrud (Statistics Norway) and Ragnar Nymoen (UiO) . The article tries to answer the question whether the empirical partial robustness in the picture can be established theoretically in a small and analytically tractable macro model which nevertheless the same defining characteristics as NAM, in particular in how wage and price formation is modelled.

The picture is taken from an article titled Forecast robustness in macroeconometric models, just published in the Journal of Forecasting, by Gunnar Bårdsen (NTNU), Dag Kolsrud (Statistics Norway) and Ragnar Nymoen (UiO) . The article tries to answer the question whether the empirical partial robustness in the picture can be established theoretically in a small and analytically tractable macro model which nevertheless the same defining characteristics as NAM, in particular in how wage and price formation is modelled.

The paper shows analytically that there are economically interesting cases where forecast errors of variables in an equilibrium correction model are immune to even regime shifts that may hit after the forecasts have been produced and published. Forecasts of the real exchange rate and the real wage are immune if dynamic homogeneity is a property of the data generating process (DGP), and the DGP is captured by the model. A reduced “real wage target” in the negotiations about nominal wage changes do not hurt the wage-share, if the models of wage setting in the model captures essential features of real world wage fixing.

In terms of econometric theory, the article points out the relationship between forecast robustness and co-breaking. The co-breaking is endogenous in the analysis given in the paper, and it is a property of the DGP.

Although there are good reason to use special-purpose statistical forecasting machines, the paper more generally indicates that the work leading to a well-specified model with (reasonably) good theoretical and empirical properties may pay off also in cases where there is “no escape” from forecasts being damaged by breaks. Structural modeling identifies parameters that are critical to forecast performance of the model—knowledge that can guide formal and informal methods of model forecast robustification, at least after the break has occurred.

Posted 15. August 2017