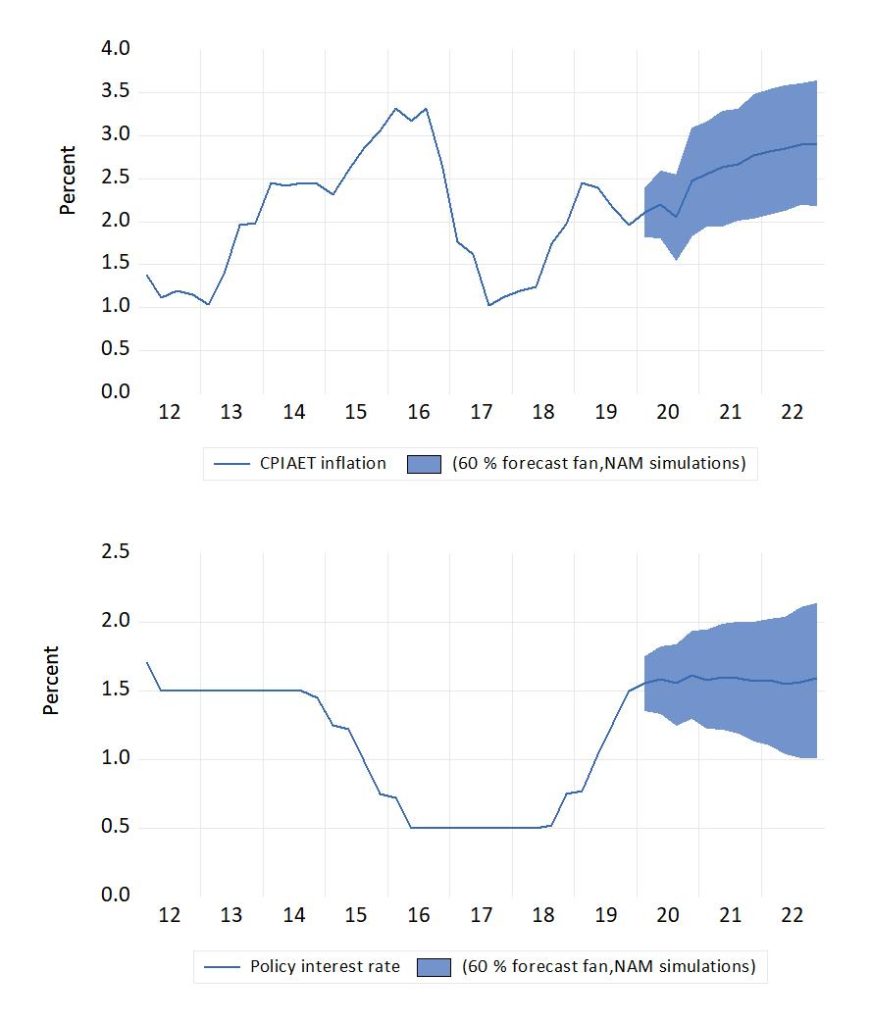

At the end of 2019, the rate of CPIAET inflation in Norway was right on the 2 percent inflation target (see graph). However, forecasts that take into account that the effect of the weakening of the international value of the krone may indicate that inflation will be moving up and away from the target. The graph in the upper panel of the figure shows one such forecast.

In the course of the winter, signals have also been strengthened about a weakening performance of the Norwegian real economy. For example, forecasts have shown, for some time already that an increase in the rate of unemployment in 2020 is plausible.

In such circumstances, Norges Bank’s projected interest rate for the future reflects the balancing of partly conflicting policy goals. The second graph in the figure shows the interest rate path from the last monetary policy report in 2019, as replicated by simulation of Norwegian Aggregate Model (NAM). Given the likelihood of higher inflation, an inflation targeting central bank might be expected to signal a higher interest rate level in the future. However, Norges Banks is not particularly inflation targeting in practice. Especially with the negative economic consequences of the new coronavirus now above the short-run policy horizon, the interest rate is more likely to be lowered, in Norway as elsewhere.

At the same time, the mechanisms behind the possible disruptive effects of coronavirus disease are in many respects different from the scenarios where interest rate reductions are believed to be effective. Reduced man-hours in production due to illness and quarantine, and resulting reduced trade with intermediary goods, are consequences that are not fixed by lowering the interest rate. Parts of aggregate demand, in particular tourisms and travel, entertainment and education, seem to be acutely impacted by virus fright, but also by health policy measures needed take down the risk of pandemic developments. Interest rate cuts will do little to raise aggregate demand as long as such factors are dominating the picture.

4. March 2020